Seacor : Dressing the Bride

Tidewater’s results were not the only bright spot in the OSV segment last week. Seacor also had something to say.

Tidewater’s results were not the only bright spot in the OSV segment last week. Seacor also had something to say. Let’s take a look.

A week after releasing their Q2 results, Seacor announced they had sold 2 liftboats (their most valuable), mainly used in offshore wind projects, for 76m$ (30m$ above book value). This is the direct continuation of the simplification they started a few quarters ago.

Let’s rewind a bit. This simplification has 2 aspects : 1/ operational and assets, and 2/ financial.

Back in early 2024, the Seacor fleet comprised 21 PSVs, 22 FSVs, 3 AHTSs and 8 liftboats. As of today, they have 19 PSVs, 21 FSVs and 5 liftboats. They sold 8 vessels for a total cash consideration of 130m$+ (including the 76m$ from the two recent liftboat sales, which hasn’t been received yet).

What did they do with the cash ?

1/ They engaged in a newbuild program : 2 premium PSVs ordered in late 2024 for 41m$ apiece (delivery Q4 26 and Q1 27). They also firmed up 4 options for similar vessels.

2/ In 04/2025, they transacted with Carlyle and repurchased their 1.3m+ shares at 4.90$ and their 1.3m warrants (they had received in the 2018 restructuring) at 4.89$ apiece. Total transaction cost : 12.9m$ for 9% of outstanding shares (assuming exercise of warrants due to 1 cent strike price).

The second part of the financial simplification happened in late 2024. In 11/2024, they refinanced their c330m$ of debt through a new 350m$ credit facility (+ 41m$ dedicated to newbuilds only). It matures in 2029 and bears interest of 10.30% fixed.

Among the instruments reimbursed, there was a convertible debt owned by Carlyle. 35m$ of principal (4.25% rate) maturing in 07/2026 with a conversion price of 11.75$ (Seacor traded <7$ at that time).

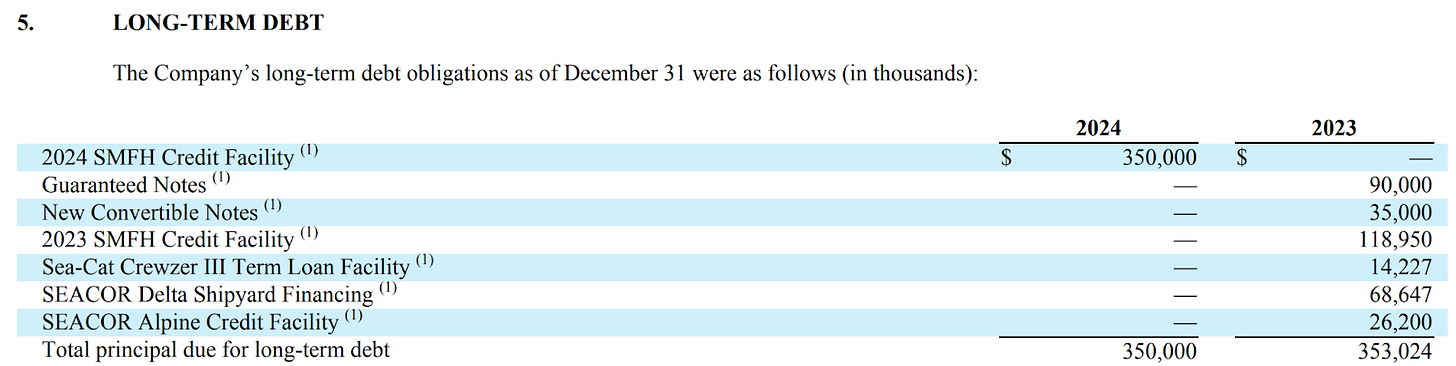

Here is what the debt looked like at the end of 2024 vs 2023:

So as of today, Seacor has :

1/ A simple capital structure with 27m shares outstanding and no more warrants.

2/ A simple balance sheet with a single debt instrument with a pro forma net debt of c230m$ and unfunded capex of c50m$ (net of restricted cash).

3/ A simpler and attractive fleet.

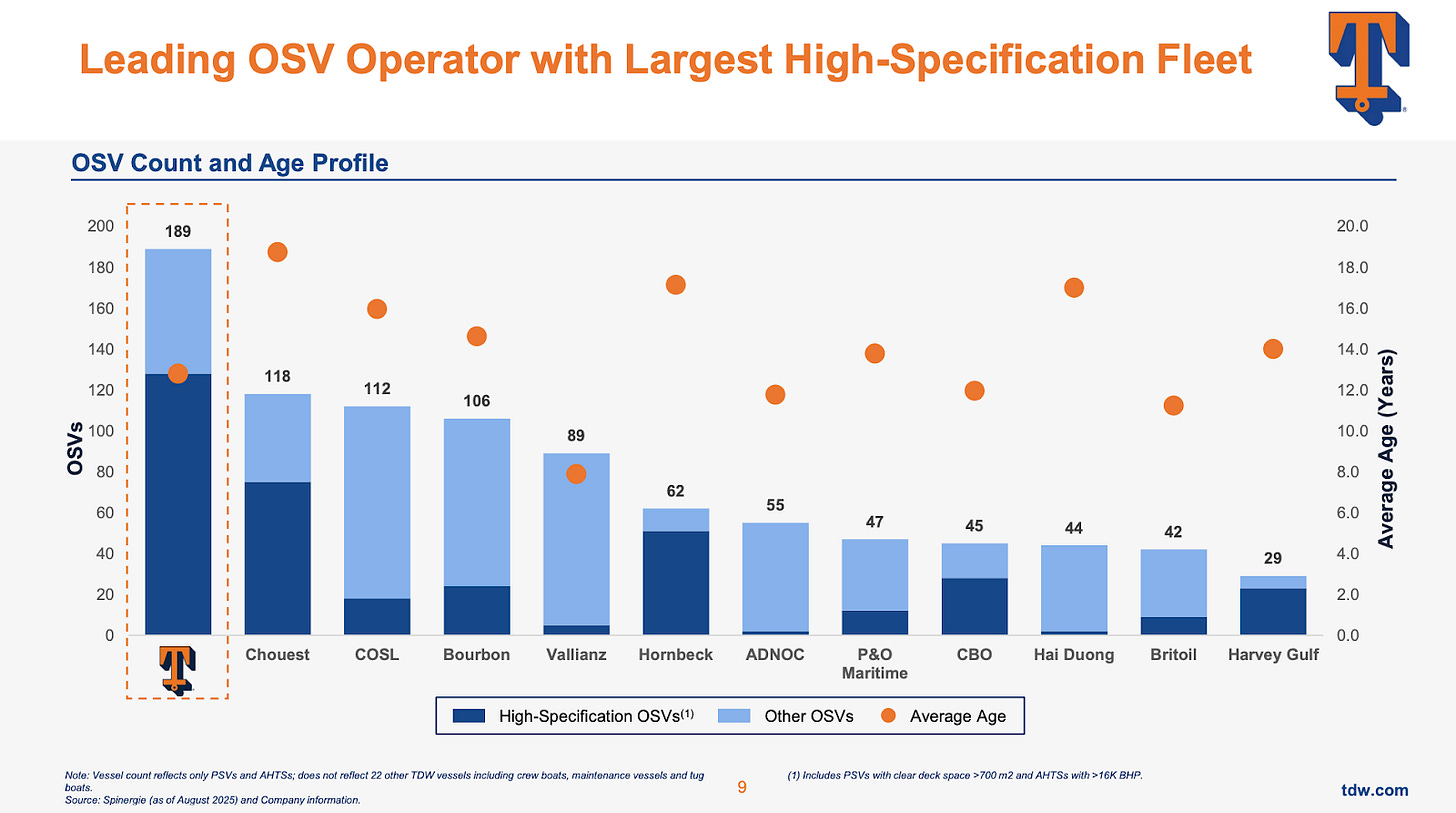

Let’s focus on the last point. Today, the PSV fleet (where most of Seacor’s value is) has an average age of 7+. Specifically, its biggest PSVs are only 6 years old and every one of them will have hybrid power soon, giving them more commercial appeal. Once the 2 new PSVs are delivered in early 2027, average fleet age will be slightly above 8 (not a small feat when your operating life is 25-30 years), way below other players of the industry :

The result of these changes is clear : Seacor’s management is dressing the bride, making it more attractive for potential suitors, especially Tidewater, the industry leader.

Tidewater itself has refinanced recently and is now able to spend its cash more freely than before. They have 2 priorities : 1/ M&A, and 2/ share buyback. And they should be able to do both with their huge cash generation.

The fact these two situations are evolving simultaneously make me think that a move on Seacor will happen in the next few quarters, as the fleet is qualitatively attractive, the balance sheet/capital structure is clean, and concentration in the industry makes economic sense.

So what could be the value of Seacor ?

1/ Replacement value/Market value of assets.

Liftboats : Seacor has sold its most premium and younger ones for 38m$ apiece, booking a 30m$+ total gain over book value (ie total book value of 45m$). As of June 2025, total book value of Liftboats was 115m$, so the 6 liftboats left are valued at 70m$. Based on recent transactions made by Seacor, I see no reason to value these liftboats at a lower price than their book value.

FSVs : in April 2025, Seacor sold one of its oldest and less specialized FSV for 4.6m$, 3x book value. As of June 2025, the book value of its FSVs is at 173m$ for 21 vessels, ie 8m$+ per vessel, half their historical construction cost, probably less than a third of their replacement value as of today, while they’re at half their useful life.

PSVs : here we have direct prices for newbuilds given by Seacor. For an equivalent of their premium PSVs, they paid 41m$. They have 10 similar to them and 9 smaller. At 35m$ each, replacement value is >650m$. Their book value is at 220m$.

Overall, the book value of Seacor is at 460m$+ (pro forma) and replacement value is well above 1bn$. At 6.30$ per share, Seacor’s EV is c410m$.

Assuming a “PSV-equivalent fleet” of 34 vessels for Seacor (1 PSV = 1 liftboat = 2 FSVs), and 200 for Tidewater, EV per vessel is 12m$ for Seacor and 15m$ for Tidewater.

Assuming a vessel cost structure similar to Tidewater, integrating Seacor’s fleet could bring Tidewater 80-100m$ of extra FCF per year (assumptions : 20k$ dayrates, 80% utilization, 9k$ daily cash cost). Aligning Seacor’s margin to 50%, by increasing dayrates to Tidewater’s current levels, would bring 120m$. At 30k$ dayrates, it brings 200m$.

This is a very compelling situation and I think it should play out quickly, so I took a position in Seacor and kept one in Tidewater.