Offshore Drilling : Here Comes the Sun

The message is quite clear : the second leg of the upcycle is about to start.

After Tidewater’s results earlier in the week, every major player in the offshore services/drilling industry has now published its latest set of results. Comments regarding future demand have been really positive from every company. The message is quite clear : the second leg of the upcycle is about to start.

The narrative has shifted from filling the whitespace in 2025-26 to preparing the fleets for the multiple new contracts to be awarded with starting dates late 26 or early 27. This suggests we’re exiting the two-tier market and focusing on the longer term. As Noble said : “I think the spot work, the gap filler work, so to speak, is going to be really separated from the rest of the work that’s out there as it prices and as people think through it. So I anticipate that to be a dynamic that plays out through 2026.”

We’ve known for quarters now that 2026 would be difficult (at least H1) due to whitespace. We saw multiple contracts firmed for DSs with dayrates in the low 400s, even below for the Valaris DS-12. Most contracts were for fill-in work, signed to weather the storm before serious things start to really pick up.

Drilling companies agree on 2 things right now : 1/ we’re in the utilization trough, and 2/ dayrates have bottomed out.

Here are a few excerpts from the calls :

Valaris : “We continue to expect that utilization for the global drillship fleet will trough late this year or early next year before improving in the second half of 2026 as rigs begin new contracts.”

“I think that day rates for high-spec ships have largely troughed in the high 300s, kind of low to mid-400 range”

Noble : “Based on current and anticipated backlog, we are tracking toward a material inflection from late 2026 onwards, which we will look to define more sharply next quarter as the next slug of foundational contracts are expected to come into backlog.”

“We’re cautiously optimistic here that day rates have bottomed. And not to say that there won’t be some lower day rates that get announced after I’ve made the statement, but we’re cautiously optimistic that from here, the market is tightening to a point late ‘26 and ‘27 that we’ve bottomed here. So stay tuned.”

Seadrill : “Our thesis is that the second half of 2026 and into ’27 is kind of where we start seeing the inflection in the market.”

“We believe that … there will be an increase in contracted utilization and meaningful day rate progression as we move from 2026 into 2027.”

Borr : “Looking into 2026, we see a market where turbulence begins to ease as the year progresses.”

“The jack-up market has bottomed, and we’re seeing clear inflection in rig demand across key regions, including Saudi and Mexico.”

Transocean : “Certainly, utilization and day rates are looking pretty solid from this point forward.”

There’s an accumulation of work starting in late 26 and 27 that is going to be sanctioned in the coming months. We’ll first have contracts at market rates to see the utilization rate pick up. Then, we’ll see rates improve nicely once the utilization is comfortably in the 90%.

Seadrill : “You’ll see utilization pick up first, and I think day rates will be a fast follower after that.“

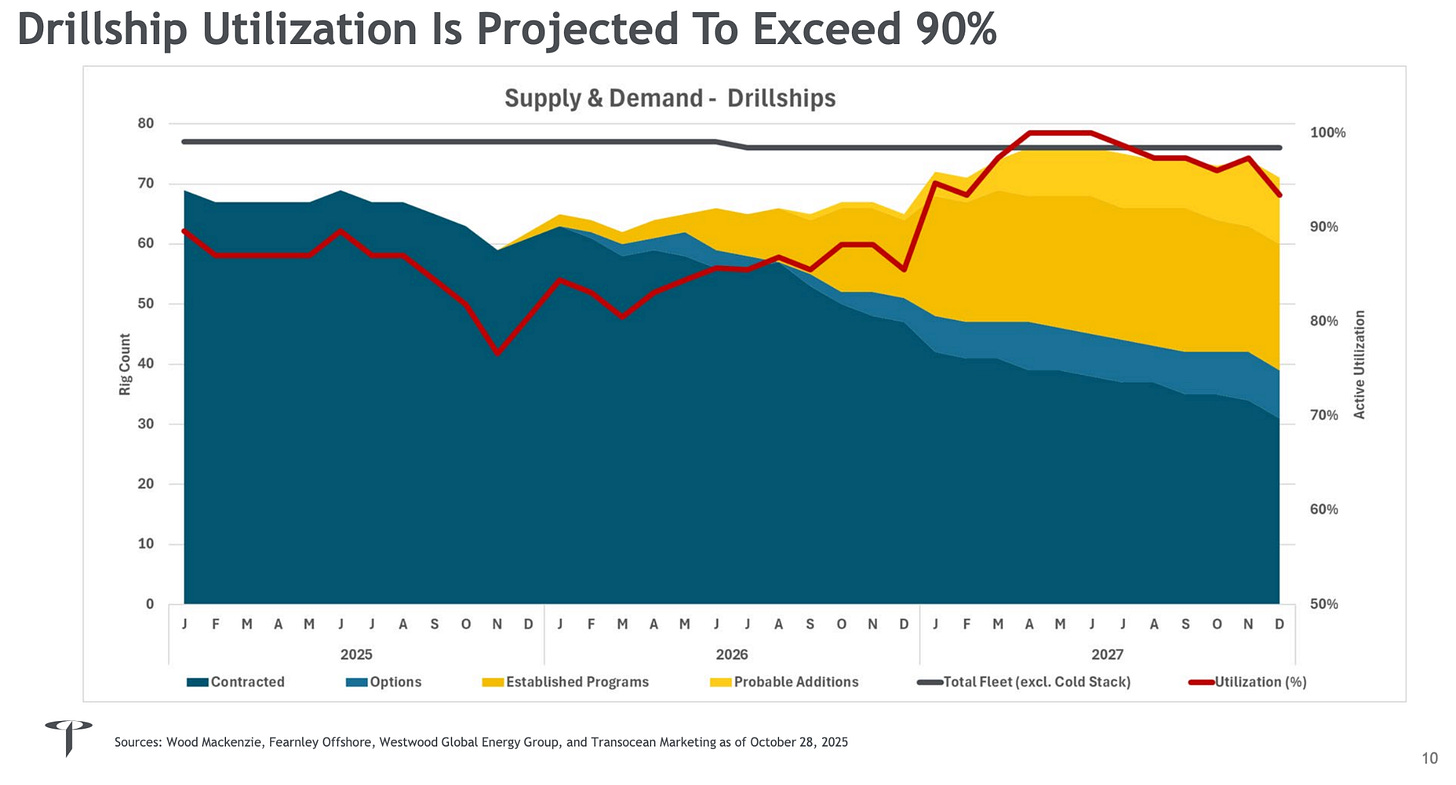

Transocean : “Utilization when it bridges 90%, that’s when the upward pressure starts exerting on rate.“

Though the market is focused on how the oil supply/demand imbalance weighs on price, IOCs and NOCs view things differently. Basically, demand continues and will continue to grow for years, but supply is kind of constrained. The world hasn’t invested enough to keep pace with future demand. We’ve been sort of complacent with that because a/ US shale covered the extra demand of the last 10-15 years, and b/ a supply crunch doesn’t happen overnight, so we kicked the can down the road (thinking peak oil was around the corner, quick energy transition etc).

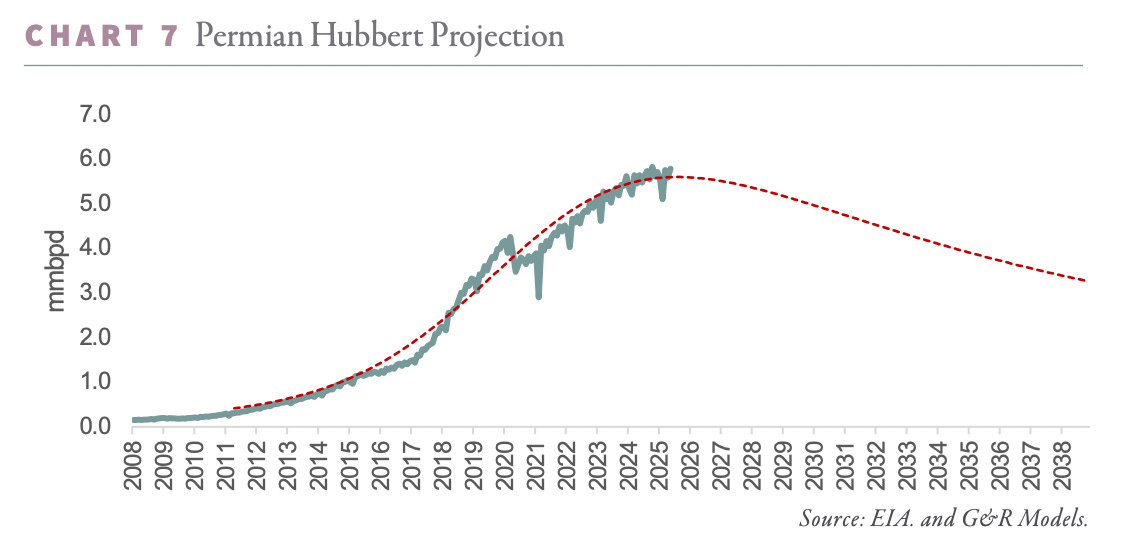

The thing is that US shale isn’t growing anymore. Goehring & Rozencwajg have been calling it for years. I encourage you to download and read their Q2 25 letter here (The Arithmetic of Depletion: Shale’s Long Goodbye). Here’s just one of their graphs you’ll find in it :

Regarding the supply risks, CEOs have been quite clear recently :

“We had a decade where people didn’t explore. It’s going to have an impact… if it doesn’t happen, there will be a supply crunch.” Amin Nasser, Saudi Aramco.

“When you have the best discovery that has been made in the past couple of decades producing only enough to cover one-third of the demand in one year, that’s a big issue.” Vicky Hollub, Occidental Petroleum

“The world’s appetite for energy continues to grow. Reliable and affordable energy remain essential for human progress. Oil and gas demand is at an all-time high. It will set another record this year, and it’s expected to do so again next year. And again, the year after that and beyond. Due simply to field decline, there’s a need for significant investment to close the oil supply gap, equivalent to five Saudi Arabians that would otherwise appear over just the next decade.” Mike Wirth, Chevron

“As an industry as a whole, I think people see that resource [unconventional/shale] and the horizon of it. And so they are shifting now to the longer term, longer cycle projects out there. From my perspective, we’ve never taken our eye off of that, continue to work it.” Darren Woods, Exxon

“From my conversations with the heads of wells and indeed some CEOs in the last quarter, that sort of period looks like ‘27, ‘28, they’re going to start releasing some capital to address those supply concerns.” Keelan Adamson, Transocean

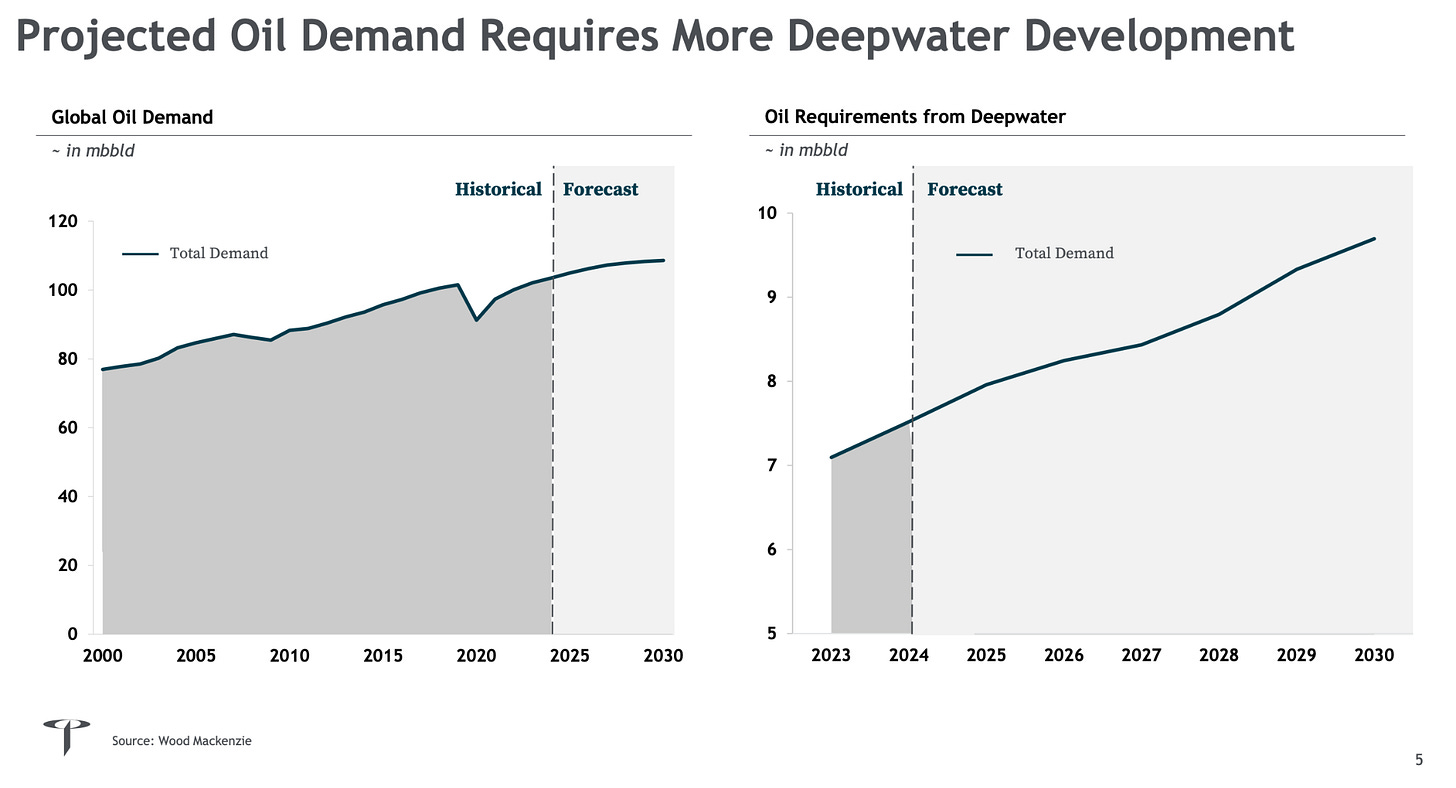

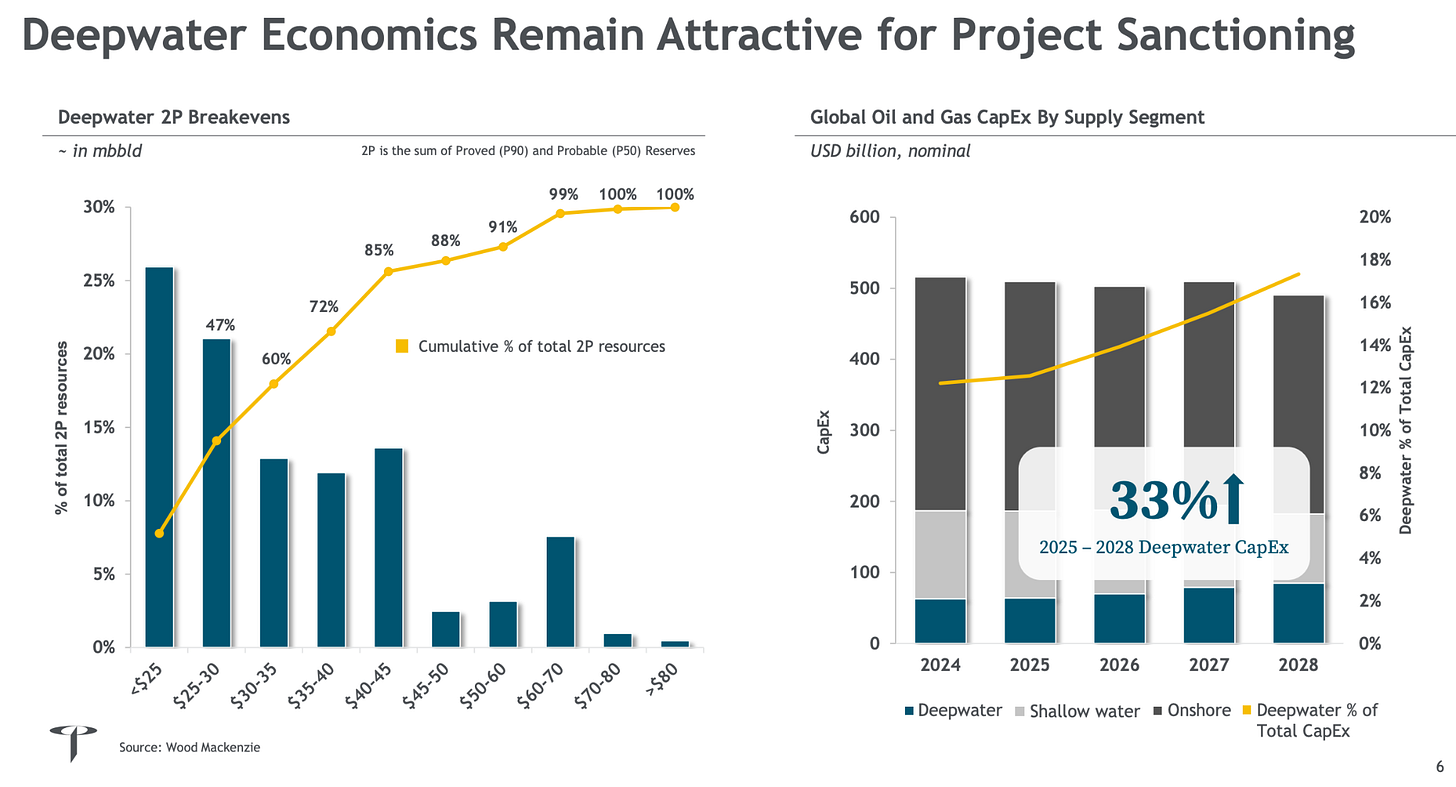

In its last presentation, Transocean shows a graph of future oil demand coming from deepwater (source : Wood Mackenzie). It goes from c7.5mbd today to >9.5mbd in 2030, +5% CAGR. Deepwater economics are highly attractive, capturing a growing share of O&G capex as onshore declines.

When you know that “nearly 90% of annual upstream oil and gas investment since 2019 has been dedicated to offsetting production declines rather than to meet demand growth,” according to the IEA, you know there’s more development and exploration coming.

Transocean : “I think our customers are going to continue to find opportunities in their programs of contracted rigs in ‘26 to put a few exploration wells in. But the conversations are now changing to a major customer talking about building an entire rig line around exploration in ‘27 and ‘28. And there’s more and more of those major customers starting to talk about that.”

Valaris : “We do see an increase in exploration discussions. And that’s based on the necessity. The consensus is that we’re going to need additional developments in order to meet the world’s energy needs as we head towards the end of the decade. And in order to get those developments, our customers need to explore.”

Seadrill : “Oil majors are calling for renewed focus on exploration and investment to avoid a future supply crunch, and there is a growing consensus that U.S. shale production has plateaued.”

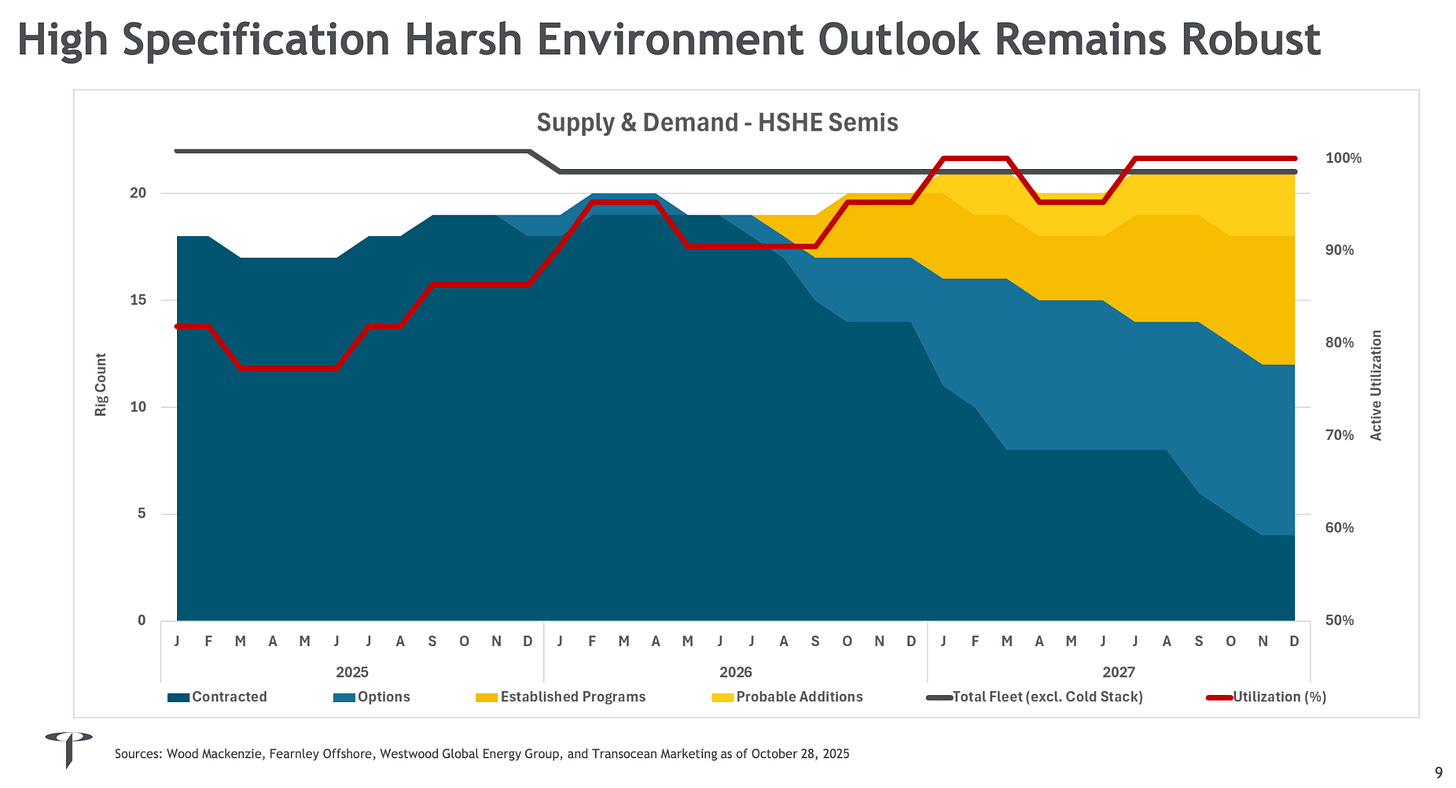

Though no company talked about reactivating rigs during their last calls (and some even talked about further scrapping more rigs), 2 slides from Transocean suggested that we might reach a reactivation scenario in 2027 :

So where can we go from here ? In the few years post-Covid, dayrates went up quite dramatically, from <$200k to >$400k for drillships for instance, before stagnating for some time at such levels. Before dayrates growth resumes, the first thing we need is to see an increase in utilization level (90%+), which we expect to see in the next 12-18 months. Only then will we see dayrates picking up nicely. As Hieronymus Bosch of Baird Maritime says : “Ninety-five per cent is the magic mark where day rates increase exponentially.”

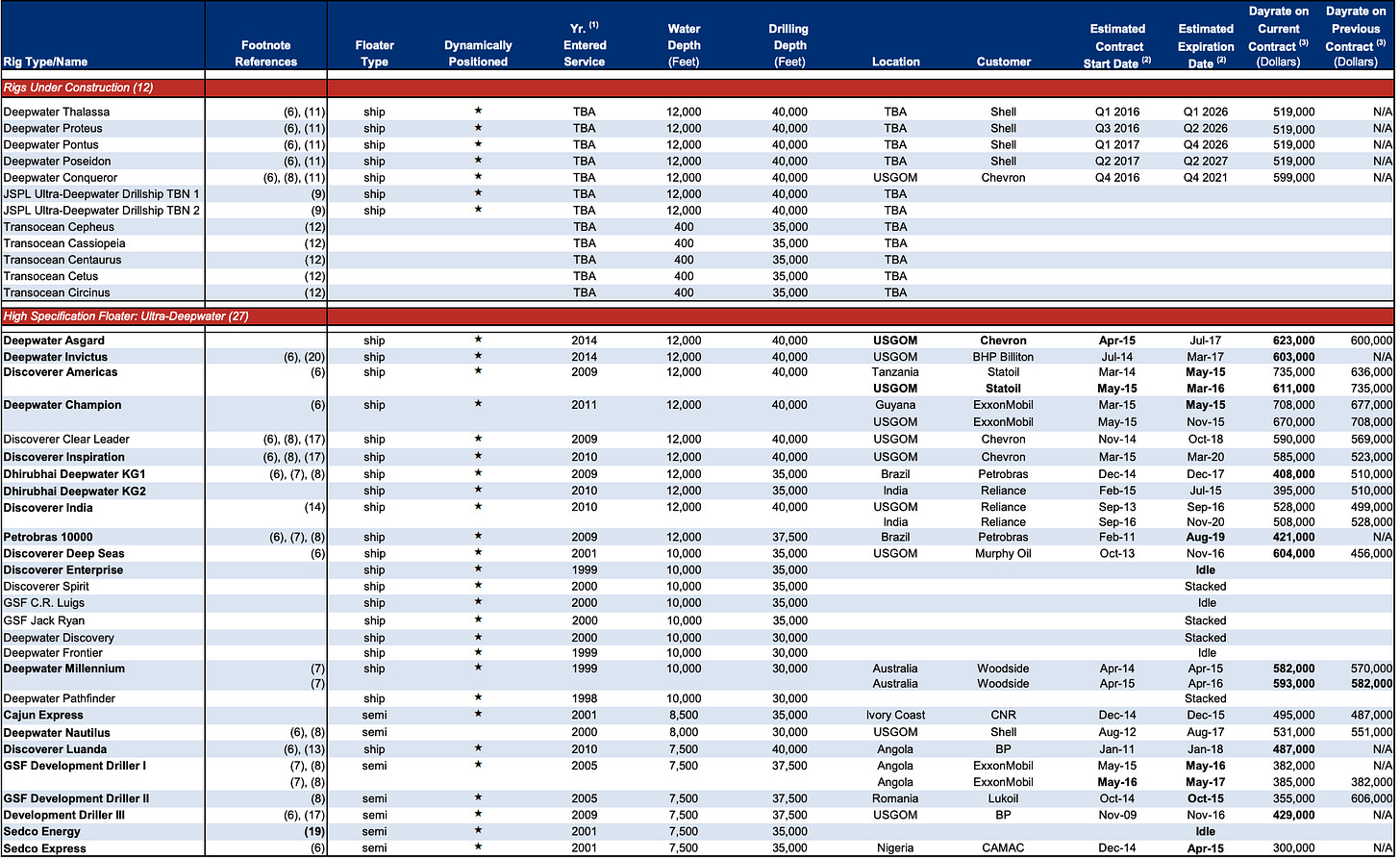

Keep in mind that hiking dayrates will be met with reluctance. As Noble said : “I think our customers are as price sensitive as ever. [...] I’d say we’re seeing extreme price sensitivity in our ongoing negotiations.” But the beauty of having a market where 75% of supply (deepwater) is controlled by 4 players, it’s that you’re kind of able to name your price. So, what ? $500k+, $600k+ for 7G rigs ? That doesn’t sound incredibly high, especially if you remember dayrates from the previous cycle. Look at that Transocean fleet status report from 2015 : so many contracts above $500k. I know, I know, top of the cycle, different situation… But still, my point is just to say that these aren’t crazy numbers, especially given the structure of the industry today, the absence of orderbook, and the new faith in offshore drilling (let’s put it that way).

I think we are at the dawn of the second leg of the upcycle, and that it will be longer than the first. Today the various fleets are offered at valuations similar to 2022/early 2023, and probably at 3-4x what they’ll earn in a few years. I think the market gives you a nice opportunity today.

Tidewater : Cash Now, Boats Soon

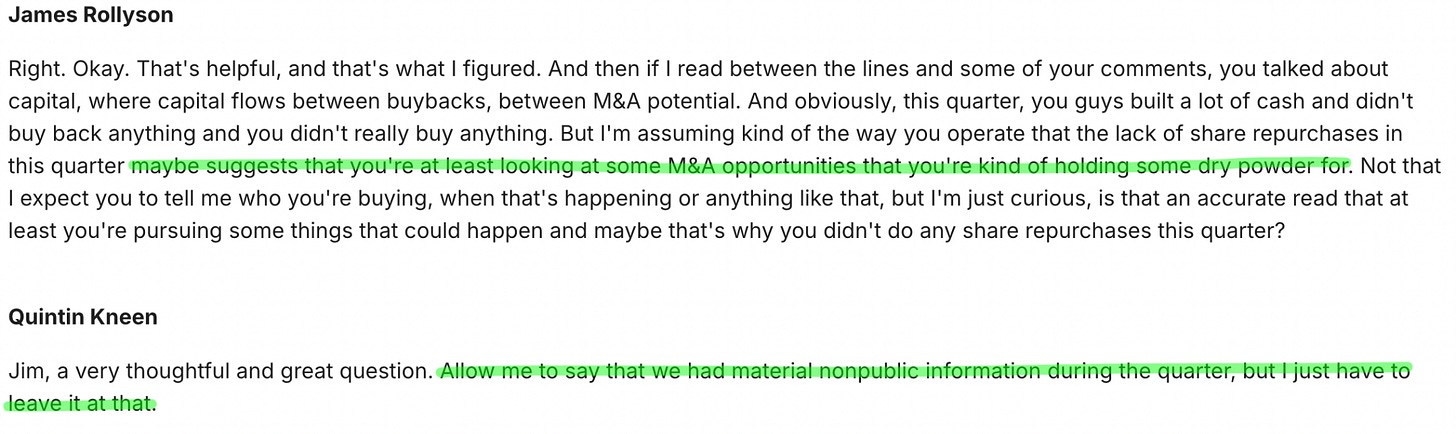

Something was quite intriguing in the TDW results published last Monday: though management succeeded in refinancing the debt in early July (cf Tidewater : free at last), and above all, in removing the share buyback limitation, we saw TDW building its cash pile during Q3, over $400m. Weird considering they had spent all they could during previous quarters, even at higher stock prices (309k shares repurchased at $95 in Q2 24 for instance).

The answer to that came directly from the CEO, Quintin Kneen, during Q&A (after extended capital allocation remarks) :

”Allow me to say that we had material nonpublic information during the quarter, but I just have to leave it at that.”

Loud and clear, Tidewater is about to use its cash for M&A. Management has for years considered acquisitions the best way to redeploy capital (and reiterated so during the prepared remarks). We saw that with SOFF and Swire, and I bet we’ll see something similar before the end of the year.

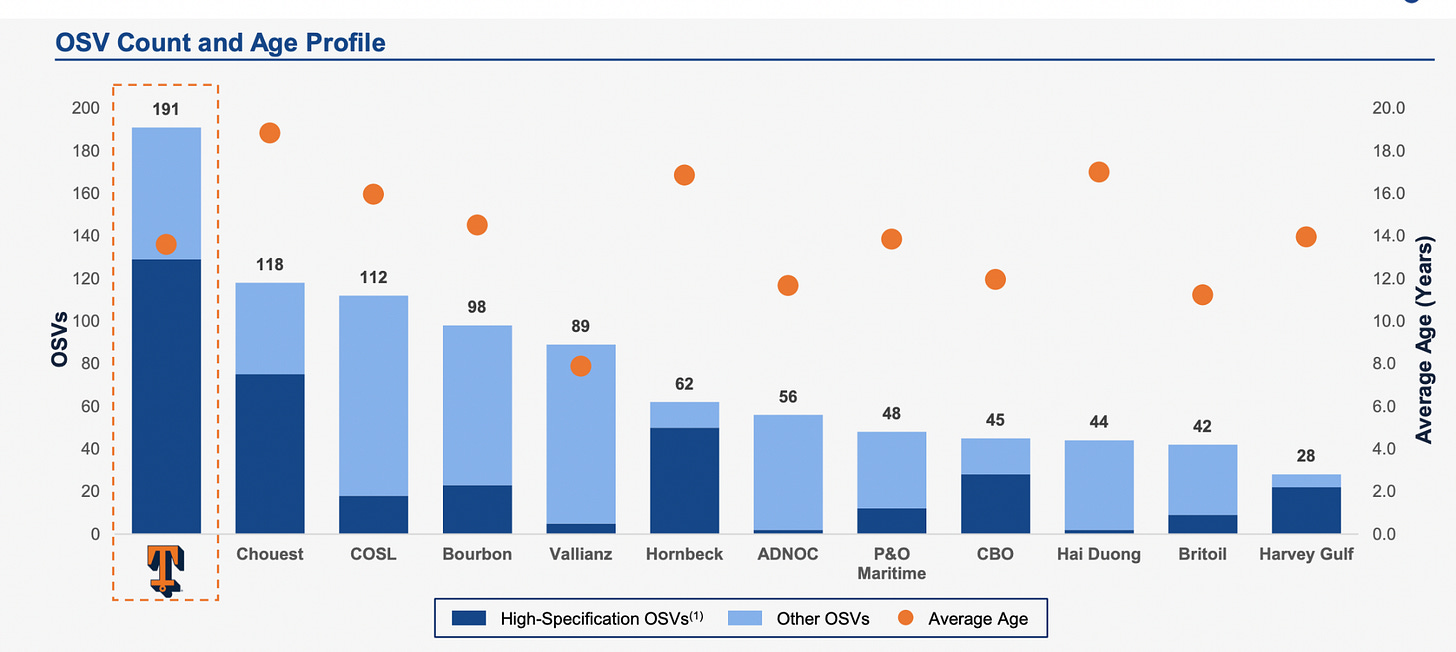

In August, I wrote about Seacor dressing the bride by selling some of its assets. It’s definitely one of the targets with its modern fleet, low valuation and interesting orderbook. With a market cap <$200m and an EV c$450m, it’s largely within TDW’s reach ($430m of cash and $250m RCF unused as of Q3 25). I saw others mentioning Hornbeck and Harvey Gulf as potential targets given the high percentage of high-spec OSVs in their fleets. Here is an interesting discussion.

Each fleet has its own advantages, with Hornbeck having 57 PSVs, most of them Jones Act-compliant (plus c15 other vessels, mostly MPSVs), though a bit older than Tidewater’s fleet. Harvey has 24 PSVs (also 3 FSVs and 1 MPSV), also mostly Jones Act-compliant, a similar age to Tidewater’s. Seacor has 19 PSVs (half hybrid), 2 more under construction, and 4 more options (plus 21 FSVs and 5 liftboats), with an average age of 7 years, much younger.

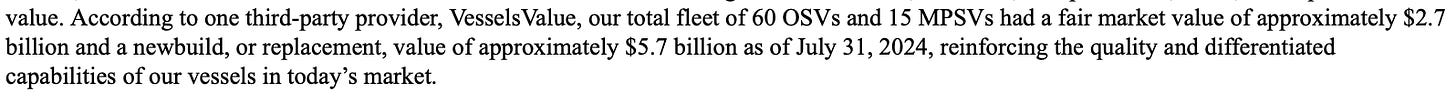

In Hornbeck S1 published in 2024 (not updated since then), it was mentioned that the fair market value of the fleet was about $2.7bn. That valued each vessel at $36m at the time vs $15m per vessel value for Tidewater today. Not sure the Hornbeck family would sell for that. In any case, that would represent $1.1bn for Tidewater to disburse - $1.5bn at $20m a vessel. Not small, but that could happen, especially if you use a bit of equity to keep the family on board (and avoid the creation of a Hornbeck Offshore 3…).

The price for Harvey and Seacor would be easier to swallow and quite similar to what they’ve done before. These three targets would make a lot of sense, and I guess I’m forgetting others too. Let’s see what happens from here, the answer shouldn’t be long in coming.

I'm long $SMHI. $SMHI is cheaper than $TDW in terms of P/NAV. I am also long $RIG, $BORR, $VAL, $NE, $SDRL.

Thank you for the article. As an offshore drilling newbie, the simplest bet for me always sounds to be Tidewater.

If things gets worse, Tidewater will suffer less, If things keep going better, Tidewater profits at least similar to peers.